Eliminate Financial Clutter and Regain Control Over Your Books

Messy books can lead to inaccurate reporting, poor financial decisions, and tax-time stress.

At KnowVisory Global, we help businesses mitigate financial clutter with automated account management processes, advanced tools and technologies, and expert oversight.

Our experts thoroughly analyze your financial records, identify discrepancies, and make them accurate, organized, and compliant with regulations. Whether it’s reconciling books, categorizing transactions, or correcting bookkeeping errors, we handle every detail to provide you with a clear financial picture of your business.

We ensure:

Comprehensive review of past transactions for error detection

Automated reconciliation of bank, credit card, and ledger accounts

Accurate categorization of income and expenses for better visibility

Elimination of duplicate or missing entries to ensure clean, compliant books

Financial Clarity Starts with a Clean Ledger

Our experts don’t just clean your accounts — they turn complex financial data into a clear roadmap for smarter business decisions.

Automated Reconciliation

Our team uses advanced accounting tools to compare records across systems. They identify missing or duplicate entries and instantly flag inconsistencies for correction.

Transaction Categorization

We carefully categorize your transactions to ensure every entry is recorded under the correct account for accurate profit and loss reporting.

Bookkeeping Corrections

We identify and fix data entry errors, outdated postings, and unbalanced ledgers, making sure your books align perfectly with financial standards.

Bank & Credit Card Matching

Our automated system reconciles all financial statements to eliminate discrepancies and ensure no transaction gets missed in the process.

Customized Account Clean-Up Services for Every Business's Needs

At KnowVisory Global, we understand that no two businesses have the same accounting challenges. That’s why, we offer customized accounts clean-up services to meet your varied business needs.

We go back in time to clean years of financial data. Our services ensure your books reflect accurate financial activity, so you can confidently move forward with a clean financial slate and better control over your accounting history.

Our automated systems seamlessly reconcile your bank statements, highlight missing transactions, and maintain clear audit trails. We review your checks, identify missing entries, and fix discrepancies to ensure there is no error in reporting the statements.

We track payables and receivables to ensure no invoice or payment is missed and your cash flow stays predictable. We track and fix the discrepancies in payments and highlight payments that are erroneously processed.

We carefully review and record every journal entry to keep your books balanced and compliant. Our experts verify every transaction and ensure its proper classification to help you get the true picture of your financial position.

Moving to a new accounting platform? Our team helps you clean, migrate, reorganize, and validate your financial data for a smooth transition across platforms.

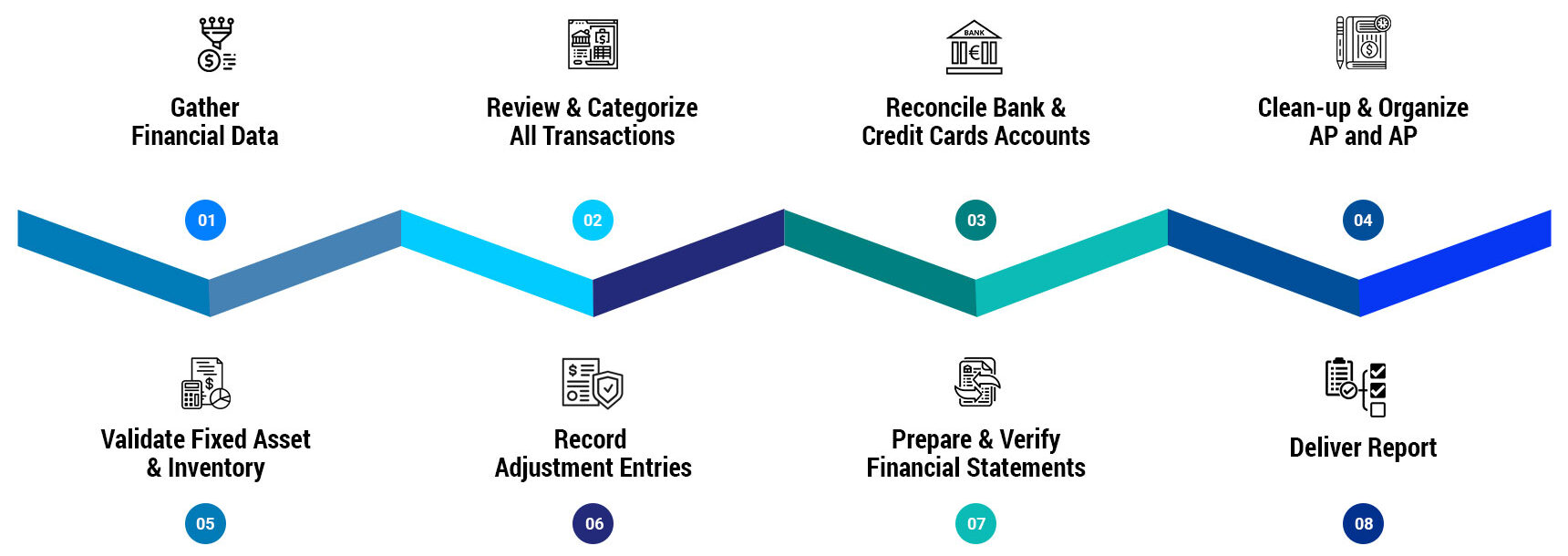

Our Account Clean-up Process

Flexible Engagement Models To

Meet Your Business Needs

Build-Operate-Transfer

We build, operate, and transfer fully functional teams for seamless operational excellence.

The KnowVisory Advantage

Our accountants have cleaned and reconciled books for hundreds of businesses across industries and geographies.

Every entry, transaction, and ledger is verified through a multi-step review process and are backed by AI-driven checks.

Our latest cloud-based accounting tools provide real-time updates and instant financial visibility.

Whether it’s a one-time cleanup or ongoing accounts maintenance, we tailor our services to your specific needs and goals.

Our expert accountants are well versed in global standards. They keep your books compliant with US GAAP, IFRS, and other regulatory standards.

We offer organized, compliant books in the shortest possible time.

Clean Books. Clear Decisions. Confident Growth.

FAQs

Why do I need an account clean up service?

Over time, businesses accumulate a lot of duplicate, missing, or misclassified entries. Account clean-up services ensure that your financial data is accurate, on-point, and compliant with the latest accounting standards.

What does an accounting cleanup include?

Account cleanup services involve reviewing and reconciling your financial records to identify and correct errors or omissions. This process typically includes:

Identifying errors and omissions in transactions

Posting adjustment Journals

Checking and updating bank and credit card transactions.

Reviewing expense categorization and asset depreciation.

Correcting discrepancies in intercompany transactions and loan records.

Reconciling all GL accounts

Ensuring accurate Balance Sheet and Profit & Loss statements.

Providing detailed reconciliation reports for all accounts.

How long does it take to clean up accounts?

The timeline depends on the volume of transactions and the level of discrepancies. For most businesses, the process takes between a few days to a couple of weeks.

Do you provide ongoing bookkeeping support after cleanup?

Yes, we do. Once your books are accurate and organized, we can provide monthly bookkeeping and reporting services to maintain complete financial accuracy.

Can you handle multi-currency or multi-entity clean-ups?

Absolutely. Our global accounting team is experienced in handling complex, multi-entity, and multi-currency financial structures. We ensure that all transactions are accurately consolidated and financial reports comply with international accounting standards.

Will my financial data remain secure?

Yes. We follow strict data security protocols so your financial information remains protected at all times.