Spoiler Alert: A tax extension does not give you extra time to pay your taxes. Neither it allows you to get a waiver for penalties or interest on late payments nor it buys you more time to contribute to the Retirement plans. It only extends the deadline for submitting your return. You’ll still need to pay any taxes owed by the original due date to avoid penalties and interest.

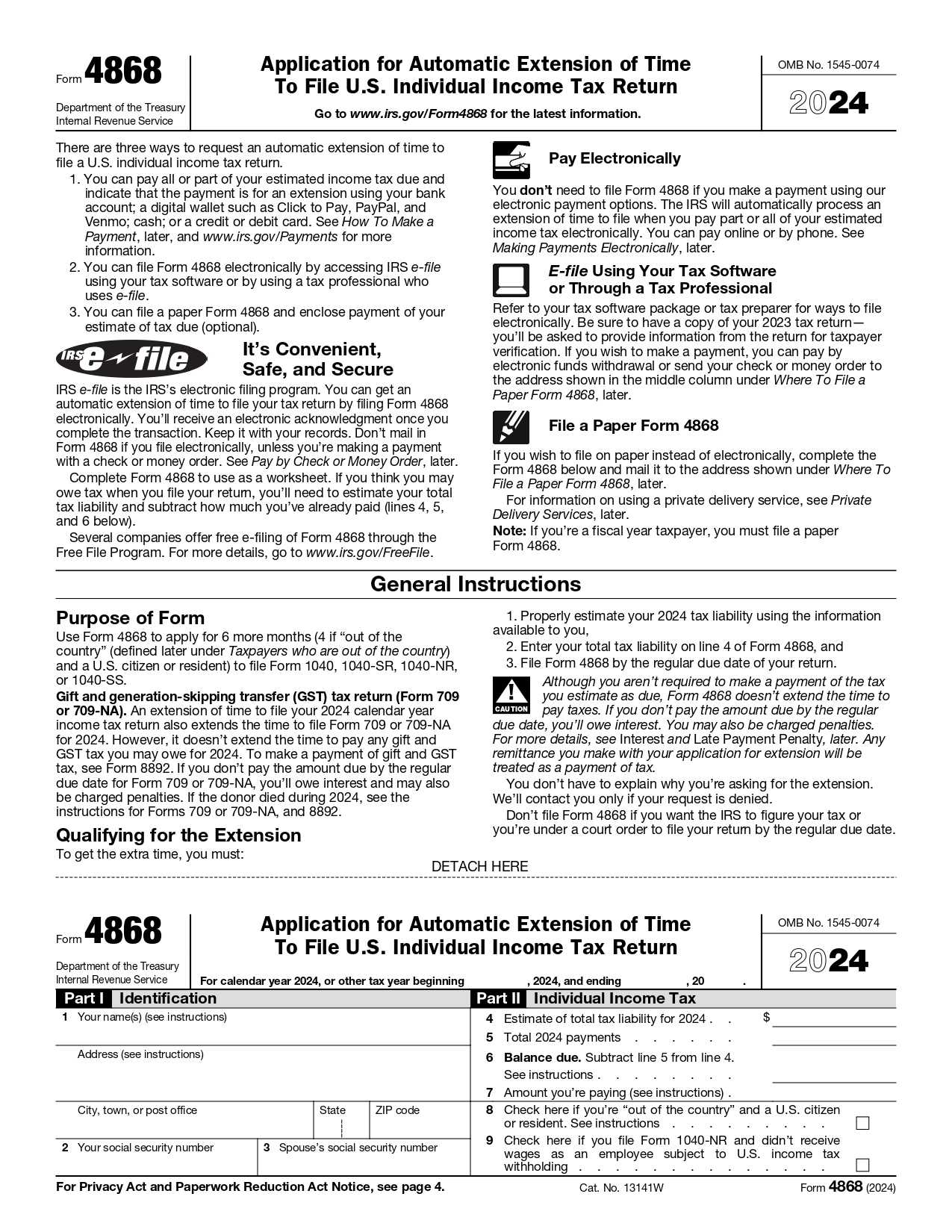

A tax extension allows you to postpone filing your tax return by six months. For 2025, submitting an extension by April 15 moves your filing deadline to October 15. To request an extension, you must file Form 4868 with the IRS, either online or by mail.

(Image Credit: IRS)

But does it really serve the purpose? Let’s find out.

When to Apply for Tax Extensions

Filing a tax extension can be helpful in certain situations. Here are some common reasons why you may consider it:

- Missing Important Documents: If you haven’t received all your tax forms, like W-2s, 1099s, or investment statements, an extension gives you time to gather them and avoid filing an incomplete return.

- Complex Financial Situations: If you have multiple income sources, investments, or business expenses that take time to calculate, an extension can help you file a more precise return.

- Unexpected Life Events: Major changes like illness, family emergencies, or moving can make it hard to file on time. An extension gives you breathing room.

- Self-Employed or Small Business Owners: If you own a business, you may need additional time to ensure all deductions, expenses, and financial reports are in order before submitting your return.

- Avoiding Errors and Penalties: Rushing through your tax return can lead to errors, audits, or missing out on deductions. More time means better accuracy.

- Affected by a Natural Disaster: If you’ve been impacted by a natural disaster – hurricane, wildfire, flood, or other emergency – the IRS often grants emergency relief and additional time to file.

- Living Abroad and Waiting for Foreign Tax Info: If you’re an American living overseas, the IRS grants an automatic two-month extension to file until June 16, 2025. Expats waiting for foreign tax documents can also file for an extension to get all their paperwork in order.

- The April 14” Syndrome: Forgot about the tax deadline? An extension gives you more time to file correctly.

- Expats with Foreign Income and Tax Credits: For expats having foreign income or tax credits, an extension gives them more time to sort out their complicated tax situation.

- Newly Married or Divorced Taxpayers: Sorting out your filing status can get tricky when undergoing a life-changing situation. An extension gives you time to figure it out confidently.

- Investors Waiting for K-1s: Still waiting on late-arriving K-1 forms from partnerships, hedge funds, or REITs? No need to rush—an extension lets you file once all the paperwork’s in

How to Apply for a Tax Extension and Who Can Do That

All or any taxpayer can apply for an extension. You just need to follow the following steps:

Estimate – You must properly estimate the tax liability that you owe for the tax year.

Report – You must report the amount of tax you owe—and it’s recommended that you pay it—to avoid interest and penalties.

Apply – You must submit Form 4868 and apply for the extension by the regular April 15 due date. You can complete and file this form electronically through tax software or mail a paper form.

The process of extension is relatively simpler, but the underlying apprehension remains: Should you apply for an extension, or should you not?

Maybe you should look at the pros and cons that we have enlisted for you below before you make a decision.

1. More Time to File Your Tax

One of the primary advantages is the additional time you get to gather necessary documents and ensure accuracy. Rushing through tax preparation can lead to mistakes that may result in costly penalties or missed deductions. By opting for an extension, you are empowering yourself to take a meticulous approach to your finances.

On the flip side, you get more time to worry about filing taxes and that may not be a pleasant situation.

2. Extended Opportunity for Deductions

If you’re self-employed or a business owner, an extension can help you maximize deductions by giving you time to make contributions that reduce taxable income. But remember, your tax payment is still due on April 15.

3. You Get More Time to Seek a Refund Later

There are two sides to look at this aspect of seeking refunds. If you have made a mistake and are seeking refunds for this term, you can do so when you‘ve filed for an October extension. But on the contrary, if you have pending refunds from the last term, this refund might get delayed.

4. You Save on Tax Preparation Fee

Tax professionals charge higher fees during peak tax season (around April). Filing later can save you money on preparation costs. However, if you owe taxes, the IRS may charge interest on unpaid balances.

5. Legal Right to an Extension

The government has recognized the challenges associated with meeting deadlines sometimes, in some cases. Hence the provision for extensions on tax filing. Moreover, there are no extra charges for filing tax extensions.

6. Complex Tax Laws

Tax laws are more complex than ever, with a plethora of intricate tax rules in comparison to just 10+ years ago. Navigating this labyrinthine system can be overwhelming, and rushing to file your return could lead to costly mistakes.

By opting for an extension, you gain valuable time to meticulously review your financial records and assess your eligibility for all available deductions and tax credits. This careful consideration can make a significant difference in your overall tax liability.

Common FAQs Related to Tax Extension

1. When is the tax extension deadline in 2025?

The deadline to file for an extension on your 2024 taxes is April 15, 2025. If you qualify for an extension, you must file your return by October 15, 2025.

2. How to file a tax extension: Online, software and other options

Filing for a free tax extension can be done in several ways right from, including e-filing Form 4868 or making an estimated tax payment by the tax deadline.

- IRS Free File: Free File is an IRS tax preparation service for taxpayers who make below a certain income, but anyone — regardless of income — can go to the IRS website to file a free extension through the program.

- Tax Software: If you plan to use tax software, most providers support filing Form 4868 for tax extensions. You can simply follow the program’s instructions and see how to file a tax extension electronically. The IRS will send you an electronic acknowledgment when you submit the form.

- Professional Tax Preparer: If you plan to work with a CPA or other tax preparer, ask if they can file for an extension on your behalf.

- By Mail: You can apply for a tax extension on paper by filling out Form 4868 and sending it to the IRS through the Postal Service. Make sure to get proof that you mailed it, and note that it must have been postmarked by April 15.

- Direct Pay: Because a tax extension only gives you more time to file, not more time to pay, it’s a good idea to estimate your taxes owed and make a payment along with your extension request. IRS Direct Pay allows you to note that you’re requesting an extension while you’re making that payment, which does away with you having to submit Form 4868 altogether.

3. How many tax extensions can you file?

Generally, you can’t request more than one tax extension per return.

4. How do automatic tax extensions work?

Some individuals receive an automatic extension without requesting it:

- S. taxpayers living abroad – Two-month extension (up to June 16, 2025) to file and pay taxes.

- Military members in combat zones – May get up to 180 additional days to file after leaving the combat zone.

- Natural disaster victims – Residents in FEMA-declared disaster areas may qualify for extended deadlines.

Whether you want to file your taxes on the due date or request an extension, partnering with experts can help you take control of your financial future. They can leverage their knowledge and expertise to ensure that every possible advantage is explored before submitting your return.

So, no matter when you file, having the right experts by your side can make all the difference. They’ll help you maximize your benefits, avoid mistakes, and take the stress out of tax season.