Cryptocurrency is a digital asset or a virtual currency that’s designed to act as money. It works through a computer network and is not regulated by any bank. The industry started around 2009 and within a decade, it achieved a staggering investment of over USD55 billion. Over the years, the demand for cryptocurrency has risen phenomenally, creating the need for centralized regulations that protect consumers while promoting innovation.

For individuals and businesses dealing in crypto, it’s crucial to understand how these digital assets are taxed. Whether you’re trading, mining, or simply holding onto Bitcoin, Ethereum, or other digital currencies, navigating cryptocurrency taxes can seem complex. The reason why most individuals and business owners rely on professional tax planning and preparation services is to ensure compliance and optimize their tax outcomes.

What are Crypto Taxes?

Per Notice 2014-21, tax authorities in the USA consider crypto to be a form of property, similar to traditional assets like stocks and real estate. This means crypto gains and losses are subject to capital gains tax, while income from crypto-related activities may fall under income tax regulations. Every time you sell, trade, or use cryptocurrency to purchase goods or services, it creates a taxable event.

A few crypto tax events include:

- Sale of a digital asset.

- Exchange of one digital asset for another.

- Exchange of a digital asset for property, goods, or services

- Receiving cryptocurrency as payment

- Receiving cryptocurrency through mining

- Staking rewards

- Airdrops

- Receiving cryptocurrency as a gift, bonus or promotion

- Crypto lending events

- Token swaps and conversions

How are Cryptocurrencies Taxed?

Cryptocurrencies are taxed when you sell, trade, or exchange them. The tax treatment depends on how long you’ve held the assets.

Capital Gains Tax

When you sell or trade cryptocurrency for a profit, the transaction is subject to capital gains tax.

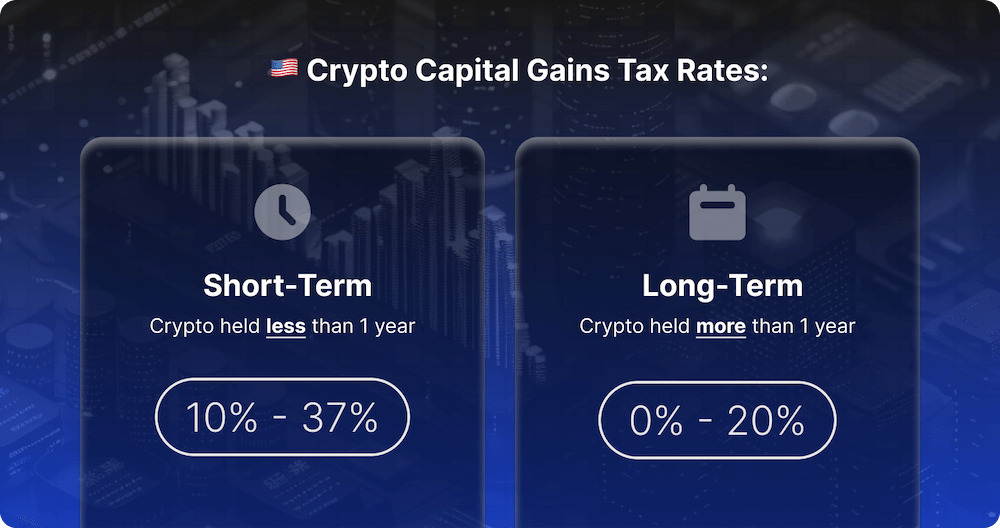

- Short-Term Gains: If you hold crypto for less than a year, your gains are taxed at ordinary income tax rates, ranging from 10% to 37%.

- Long-Term Gains: If you hold crypto for more than a year, you may benefit from lower tax rates of 0%, 15%, or 20%, depending on your income bracket.

(Image Credit: Blockpit.io)

For example, if you bought Bitcoin for $10,000 and sold it for $15,000 within a year, the $5,000 profit would be taxed as short-term capital gains at your regular income tax rate. If you held it for more than a year, the $5,000 would be taxed at the lower long-term capital gains rate.

Here’s a breakdown of tax rates for both short-term and long-term gains:

Short-Term Capital Gains Rates (Held Less Than 1 Year)

| Tax Rate | Single | Head of Household | Married Filing Jointly | Married Filing Separately |

| 10% | $0 to $11,000 | $0 to $15,700 | $0 to $22,000 | $0 to $11,000 |

| 12% | $11,001 to $44,725 | $15,701 to $59,850 | $22,001 to $89,450 | $11,001 to $44,725 |

| 22% | $44,726 to $95,375 | $59,851 to $95,350 | $89,451 to $190,750 | $44,726 to $95,375 |

| 24% | $95,376 to $182,100 | $95,351 to $182,100 | $190,751 to $364,200 | $95,376 to $182,100 |

| 32% | $182,101 to $231,250 | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 |

| 35% | $231,251 to $578,125 | $231,251 to $578,100 | $462,501 to $693,750 | $231,251 to $346,875 |

| 37% | Over $578,126 | Over $578,101 | Over $693,751 | Over $346,876 |

Long-Term Capital Gains Rates (Held More Than 1 Year)

| Tax Rate | Single | Head of Household | Married Filing Jointly | Married Filing Separately |

| 0% | Up to $44,625 | Up to $59,750 | Up to $89,250 | Up to $44,625 |

| 15% | $44,626 to $492,300 | $59,751 to $523,050 | $89,251 to $553,850 | $44,626 to $276,900 |

| 20% | Over $492,301 | Over $523,051 | Over $553,851 | Over $276,901 |

Income Tax

Cryptocurrency earned through mining, staking, airdrops, or as payment for goods and services is taxed as ordinary income. The value of the crypto at the time of receipt is added to your taxable income and taxed according to your income tax bracket (10%-37%).

For instance, if you mined Ethereum worth $5,000, that amount would be taxed as income in the year it was mined.

Also, it is worth noting that different agencies in the US recognize cryptocurrency differently. This has led to the creation of distinct laws surrounding this digital asset. For example, in Wyoming, you don’t need a license for cryptocurrency. However, you’ll need a Money Transmitter License (MTL) to trade in cryptocurrency in Colorado.

Tax Exemptions and Crypto Losses

Certain crypto transactions may be exempted from tax. For example, small transactions, like those below a specific threshold, may not trigger taxable events. Similarly, cryptocurrency losses can be used to offset capital gains (or up to $3,000 of ordinary income annually), which helps in reducing your overall tax liability. When offsetting your capital gains with losses, pay attention to the holding period of the assets under consideration. You can only offset long-term capital losses against long-term capital gains and short-term capital losses against short-term capital gains. Excess of losses can be carried forward.

Some events that may not trigger a tax obligation include:

- Purchasing cryptocurrency with cash.

- Receiving cryptocurrency as a bona fide gift.

- Holding cryptocurrency (Taxes only apply when you sell or trade the asset.)

- Transferring cryptocurrency between your own wallets or accounts

- Crypto Donations (Donations of cryptocurrency to a qualified charity can be deducted from your taxes, similar to traditional donations.)

Non-Traditional Forms of Cryptocurrency

Cryptocurrency is not the only form of digital asset that is taxed. Another form of cryptocurrency, Non-Fungible Tokens, or NFTs, are also taxed.

NFTs are unique digital assets that use blockchain technology like cryptocurrency to signify digital ownership. They are categorized as property, meaning the sale and trade of cryptocurrencies are taxable. Some NFTs, on the other hand, may be considered collectibles, and are taxed at higher rates than other types of property.

Strategies to Minimize Cryptocurrency Taxes

Want to minimize your crypto taxes? Here are some strategies to follow:

- Hold Crypto for Long-Term Gains: Holding cryptocurrency for over a year before selling allows you to benefit from lower long-term capital gains tax rates.

- Leverage Tax-Loss Harvesting: You can offset capital gains by selling underperforming assets at a loss, reducing your taxable income.

- Gift Crypto to Family Members: Gifting cryptocurrency can be a tax-efficient strategy, especially if the recipient is in a lower tax bracket.

Recording and Reporting Crypto Taxes

Properly recording and reporting your cryptocurrency transactions is crucial to staying compliant with IRS regulations. Failure to do so can lead to penalties, interest, and even potential legal consequences. Here’s how to ensure you’re correctly recording and reporting your cryptocurrency taxes:

Maintain Detailed Records: Make sure to record the date of each transaction, the amount of crypto involved, the fair market value at the time of the transaction, and any associated fees.

Many crypto investors rely on third-party tools to automate the process of recording transactions. These tools integrate with popular exchanges and wallets, helping you track the cost basis, gains, and losses automatically.

Identify Taxable Events: Taxable events in cryptocurrency can be categorized into capital gains and income. Make sure to accurately identify and record them.

File Crypto Gains and Losses on Form 8949 and Schedule D: Report your cryptocurrency capital gains and losses by filling out IRS Form 8949 and Schedule D. While Form 8949 reports the sale, disposals, and exchange of capital assets, including cryptocurrencies. Schedule D summarizes the net gain or loss from all your capital transactions, including cryptocurrency.

Report Crypto Income on Form 1040: If you’ve earned income from cryptocurrency activities, such as staking, mining, or receiving crypto as payment, report it on your Form 1040.

Offset Gains with Losses (Tax-Loss Harvesting): Use tax-loss harvesting to reduce your taxable capital gains. This means that if you’ve incurred losses on certain cryptocurrency transactions, you can use these losses to offset gains in other transactions.

Report Foreign Cryptocurrency Holdings (FBAR and FATCA): If you hold cryptocurrency in foreign exchanges or wallets and the total value exceeds $10,000, it is important to file a Report of Foreign Bank and Financial Accounts (FinCEN Form 114) or disclose the holdings under the Foreign Account Tax Compliance Act (FATCA) (IRS Form 8938).

Stay Updated on IRS Crypto Guidelines: Cryptocurrency tax rules are quickly evolving. It is important to stay updated on the latest IRS guidance. Consulting a professional tax consultant who specializes in cryptocurrency can help ensure you’re following the correct procedures and maximizing deductions.

So, if you have questions or need help calculating your crypto tax, contact us. Our experienced financial advisors are here to help you every step of the way. They can address all your queries and concerns around Cryptocurrency taxes and help you report your taxes correctly to avoid fines or legal disputes. Reach out to us today for strategic tax planning and preparation.