Let’s be honest: Accounts Payable (AP) always had a reputation to uphold. Most

On paper,

accounts payable always looks like a simple process. Invoices come in, someone checks them, approves them, and then pays them. But if you’ve done it yourself, you know the drill. Invoices pile up, approvals get stuck in email chains, and mistakes happen – sometimes the costly ones.

If fact, according to the

Institute of Financial Operations & Leadership (IFOL), around 56% of AP teams spend more than 10 hours per week on manual invoice processing.

This is where AP automation comes in. It is a process of digitizing your invoice-to-payment process and letting technology handle the boring, repetitive stuff. Instead of relying on spreadsheets or paper invoices, you use the power of technology to build a connected system. One in which AI automatically captures the invoices, checks them against purchase orders, flags mistakes, and sends them to the right person for approval – all without anyone typing numbers or tracking invoices manually.

For many businesses, especially the small and the medium-sized ones, AP automation is a lifesaver. Handling invoices manually works when volume is low. But when there are hundreds or thousands of invoices a month, manual AP workflow slows you down. It leads to errors and makes it hard for you to see your actual financial position. Automation fixes that by making everything faster, more accurate, and easier to track.

|

Also Read: Understanding Accounts Payable & How It Improves Your Bottom Line|

The Challenges of Manual Accounts Payable Processes

Manually handling the accounts payable process is very tedious: invoices show up in different formats (PDFs, scanned copies, and sometimes even on paper). They land in your inbox and have to be keyed into the system one by one. If the invoice doesn’t match the purchase order, you have to chase down the details. Approvals might get lost in endless email chains. Then, by the time the invoice is ready to pay, you realize that you’ve already missed the early payment discount – or worse, you’re hit with late fees.

Manual AP also leads to errors and frauds. Even a single misplaced decimal or duplicated invoice can lead to serious financial losses. And because there’s no real visibility into the process, it’s hard to catch problems until it’s too late. Your finance team is stuck chasing approvals and rechecking numbers. That’s money and talent tied up in paperwork rather than growth. Not to forget the strained vendor relationships that missed or delayed payments lead to.

That’s why today, more and more businesses are turning to AP automation—not just to save time, but to transform the way they manage payables.

Manual AP vs Automated AP: The Key Differences

| Manual Accounts Payable |

Automated Accounts Payable |

| Longer invoice processing time. Clearance may take from days to weeks as invoices get stuck in inboxes or paper trails |

Invoices move automatically through the system, and payments can be made in hours. |

| Prone to errors due to typos, duplicates, and missed entries |

AI validates all entries and flags mistakes. This leads to minimum errors and mistakes. |

| High cost per invoice. Approx. $10–$15 on average (labor, paper, storage) |

You spend only $2–$4 on average per invoice (mostly software cost) |

| Payments often get delayed. This leads to strained vendor relationships |

On-time payments strengthen trust and open discounts |

| Manual accounts payable processes require more staff as volumes keep increasing as the business grows |

Scales effortlessly without adding headcount |

| Offers limited financial visibility. Reports are slow and outdated |

Real-time dashboards provide instant insights |

| Lengthy audit process as reports need to be pulled manually |

Automated logs and digital records make the audit quick and seamless |

The Accounts Payable Automation Process

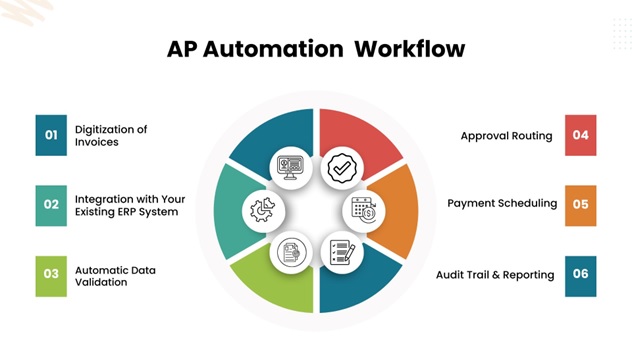

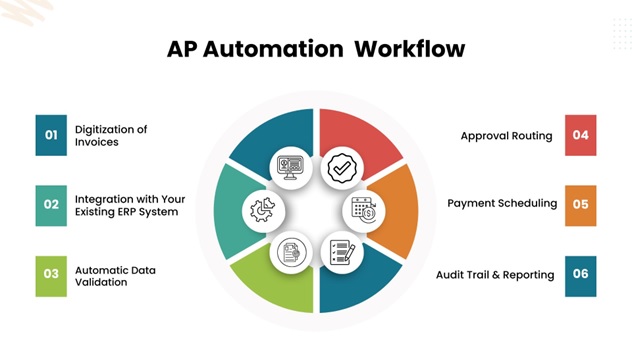

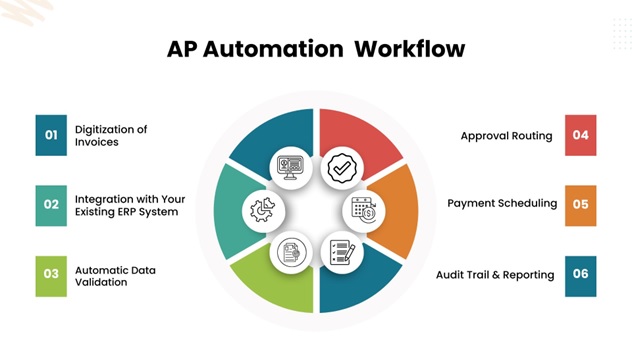

As mentioned above, automation of accounts payable system is a process of setting up a connected workflow where invoices flow in automatically, data gets validated, approvals are streamlined, and payments are tracked—all without manual intervention. Here’s a step-by-step process of the AP automation workflow:

1. Digitization of Invoices

The first step is to get rid of paper clutter. All invoices are captured and recorded. Tools use

OCR (Optical Character Recognition) and

AI to read invoice details like vendor name, invoice number, date, and amount.

2. Integration with Your Existing ERP System

AI powered AP automation tools like

Stampli,

NetSuite,

Coupa, etc., plug into your existing accounting or ERP system. This ensures that your invoices directly flow into the system that you are already using for maintaining financial records.

3. Automatic Data Validation

AI tools automatically check invoices against purchase orders (POs) and goods receipts. This is known as two-way or three-way matching.

4. Approval Routing

Then the invoices are routed to the right people via email, based on pre-set rules. Like, for example,

- Marketing invoices go to the marketing manager.

- Anything above $5,000 goes to the CFO.

5. Payment Scheduling

Once approved, the payments are automatically scheduled as per the instructions. You can choose to:

- Pay immediately

- Hold until the due date

- Or capture early-payment discounts

All payments are tracked inside the system.

6. Audit Trail & Reporting

Every step in the process gets automatically recorded. Like who approved the invoice, when it was paid, what was flagged, and so on. This creates a complete audit trail without any manual work. Real-time dashboards show pending invoices, payments due, and overall cash flow.

Advantages of Accounts Payable Process Automation

AP automation not only reduces manual labor, it saves time, prevents errors, and reshapes the way your finance team works. With more time at hand, they can now focus on strategic tasks. The benefits that businesses typically experience include:

- Faster Invoice Processing:

What once took days or weeks can now be done in hours. Bills get cleared on time. No reminders or follow-ups.

- Fewer Errors:

Automation processes lead to fewer AP errors. Your system automatically validates every invoice and flags duplicates or suspicious entries before releasing the payment. It makes sure nothing gets missed in the process.

- Significant Cost Savings:

Automation helps businesses save a lot of money. They not only save on resources but can also avail discounts early payment. In fact, it has been reported that with AP automation, businesses can save up to 80% costs on invoice processing.

- Better Vendor Relationships:

Delay in payments leads to unhappy clients and even legal disputes. AP automation helps you process all your invoices on time. This leads to stronger vendor relationships.

- Real-Time Financial Visibility:

Automated dashboards give a real-time view of pending invoices, payment status, and cash flow. This helps in smarter decision-making. Teams can plan upcoming expenses or negotiate discounts with confidence.

- Scalability Without Extra Staff:

As your business grows, invoice volume grows too. This usually means hiring more staff. Automation saves you the hassle of hiring more accountants and bookkeepers. The same system can handle thousands of invoices per month, letting you scale without additional overhead.

- Complete Audit Readiness:

AP automation keeps you audit-ready. It creates a complete process trail, and helps you stay compliant with internal policies and external regulations.

Common Myths Around AP Automation

Many businesses hesitate to implement AP automation because of misconceptions. Let’s debunk a few:

“AP automation is only for big companies.”

Small and mid-sized businesses often gain the most benefits, as they can afford neither inefficiencies nor high resource costs. Automation helps them scale easily.

“Accounts payable automation solutions are too expensive.”

Most

AP automation tools are cloud-based and priced per transaction or user. The cost outweighs the savings from reduced errors, faster processing, and fewer late fees.

“It will lead to job cuts.”

Automation doesn’t replace resources; it makes them more efficient. By eliminating repetitive, time-consuming tasks, it allows your AP teams to focus on more strategic work like cash flow optimization, budgeting, and vendor management.

“Implementation will disrupt workflows.”

Modern tools are built for speed. They are quick to setup and easy to work with.

Key Challenges in Accounts Payable Invoice Automation

While AP automation brings massive benefits, getting started isn’t always smooth sailing. Here are some common hurdles businesses face:

- Resistance to Change

Teams often get comfortable with manual processes. They may find it difficult or, rather, uncomfortable to move to an automated process.

- Integration Roadblocks

Your business might be running on multiple accounting platforms. Integrating them into your new system is important. Always choose a software that works well with your existing setup. It will avoid disruptions.

- Data Accuracy During Migration

Transferring years of financial data into a new system isn’t just about uploading files—it requires careful validation. Any slip here can lead to errors that affect reporting and compliance.

- Upfront Investment

Even though automation pays for itself over time, the initial costs—software licenses, setup, and team training—can feel like a barrier for smaller businesses. Planning for ROI early helps ease the concern.

- Need for Customization

No two businesses handle payables the same way. Custom workflows often need to be built into the system so it fits how your approvals and payments actually work.

Partner with Experts to Avoid These Hurdles

Accounts Payable automation is a strategic business transformation. That’s why partnering with experts matters. With the right support, you can:

- Choose the right AP automation tools for your business.

- Ensure seamless integration with your existing ERP or accounting system.

- Easily train your staff on new software.

- Build custom workflows that match your approval processes.

- Avoid common pitfalls like data migration errors or vendor misalignment.

At

KnowVisory Global, we bring proven expertise in AP automation and financial process optimization. Our team can not only provide you support with your manual AP processes, they can also help you set up a system that not only works today but scales with your growth tomorrow.

So, don’t let AP challenges slow down your business. Partner with KnowVisory Global and transform your payables into a growth enabler.

Contact us today.