To overcome these challenges, around 70% US firms turn to offshore delivery partners in India to scale their accounting operations efficiently.

The reasons are many. For example,

- 59% of U.S. businesses outsource work to reduce costs and focus on core tasks

- 57% cite increased productivity and access to skilled talent as their main reason

And this trend isn’t slowing down. In fact, by 2028, the global finance outsourcing market is expected to reach $93.2 billion, with India being the leading hub.

That said, “outsourcing” doesn’t look the same for every business; multiple models exist. Yet two of the most popular approaches that companies consider to strengthen their operations are:

- Build-Operate-Transfer (BOT) model and

- Staff Augmentation

Both help US firms close the talent gap at affordable prices while streamlining their financial operations without overhead expenses.

What is Staff Augmentation?

Staff Augmentation is an outsourced accounting model that allows you to “rent” experienced accountants and bookkeepers from a service provider to extend your in-house service capabilities. It allows you to instantly expand your team without adding permanent headcount. The accountants technically belong to your service provider, but you decide their tasks and manage their output.

Example: A CPA firm in New York needs extra tax preparers during tax season. The company chooses staff augmentation. The company gains immediate support without committing to permanent hires.

Advantages:

- Speed — teams can be onboarded in a matter of days

- Flexibility — scale up or down as projects demand

- Zero HR or payroll headaches overseas

- Plug-and-play expertise for audits, tax prep, or bookkeeping

Where It Falls Short:

- Costs add up if it becomes a permanent solution

- Company culture and policies don’t always match

- Critical knowledge gap when an employee exits/ contract ends

What is the Build-Operate-Transfer (BOT) Model?

BOT is a strategic, long-term team-building model that allows you to build, operate, and own an offshore team without upfront costs or investment. Here, an outsourcing partner builds and manages an offshore accounting team, handling recruitment, HR, compliance, and IT. Once stable, the team is transferred to you as a “fully owned offshore center” that works as per your company policies, follows your team culture, and seamlessly integrates into your existing finance operations – just like an extension of your U.S. office.

Advantages:

- Long-term savings — no vendor markup once the team is yours

- Control — full say in hiring, training, and compliance

- Scalability — structured growth instead of ad hoc hiring

- Security — data, processes, and IP stay in-house

Challenges:

- Requires 2–3 months for setup and stabilization

Example:

A Fortune 500 company in New York uses a BOT to establish a 200-member offshore accounting hub in India. After two years, the team transitions fully under their ownership, reducing operational costs by 40% compared to U.S. hiring.

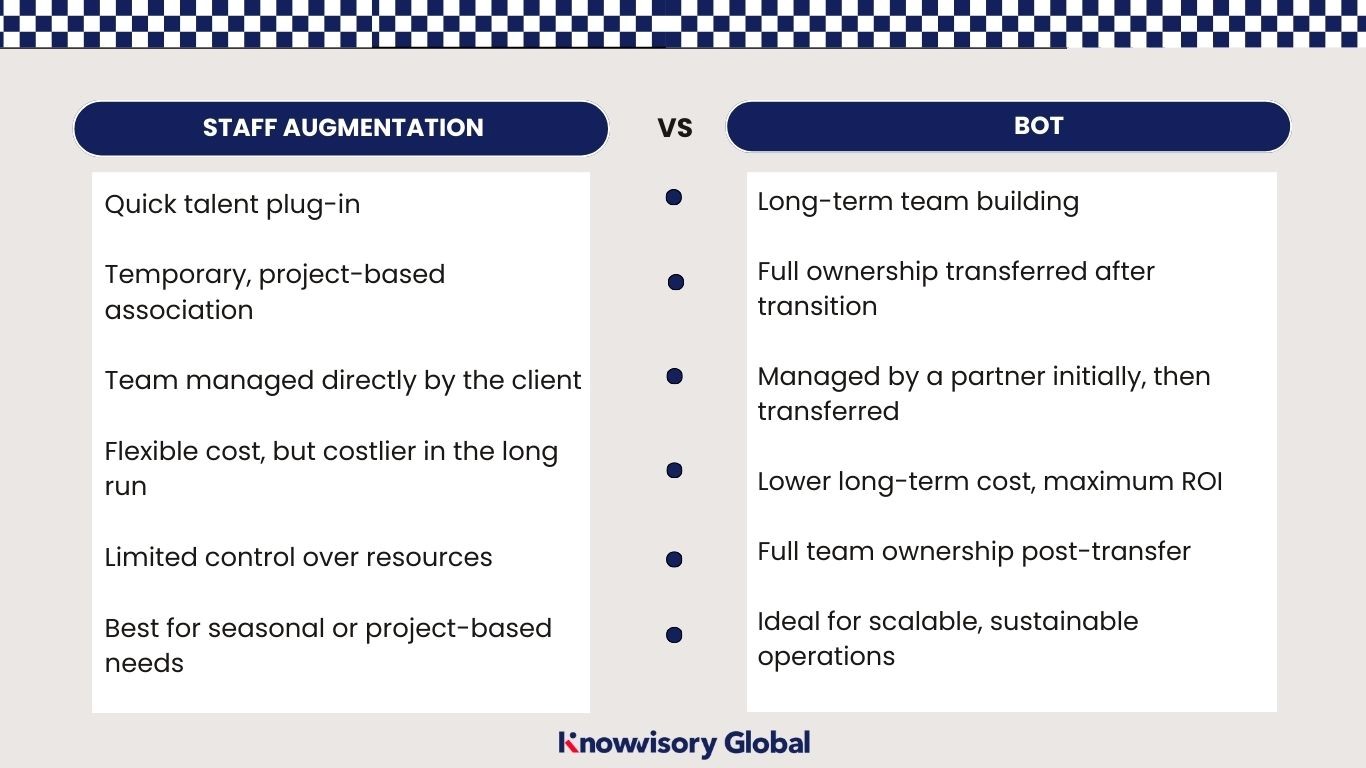

Comparing BOT and Staff Augmentation Models

Why Companies Choose Staff Augmentation

CPA firms and mid-sized companies often choose staff augmentation to fulfill their immediate, short-term project needs. It gives them the:

- Speed and flexibility they needed to plug their skill gaps

- Ability to manage seasonal workload, especially during busy tax seasons

- Access to specialized expertise on demand

- Up to 40% reduction in hiring and training costs, since resources are already pre-vetted by the provider

- Scalability to ramp teams up or down based on client projects and filing deadlines

- Lower risk compared to permanent hires, as engagements can end once the project is complete

Why Companies Choose BOT

Larger CPA firms, fast-growing accounting practices, and mid-sized companies planning for global expansion often choose the Build-Operate-Transfer (BOT) model. It gives them the:

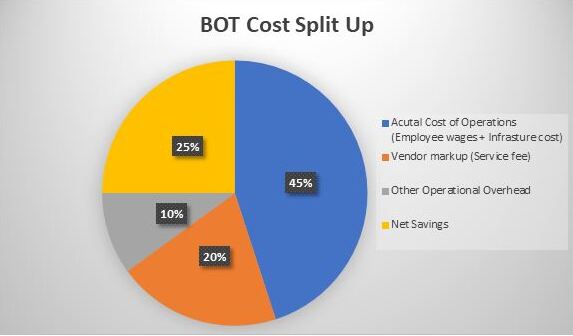

- Long-term cost advantage as they own their offshore accounting center after the transfer phase

- Direct control over teams, culture, and processes, ensuring consistency with U.S. operations

- Ability to build specialized offshore capability in areas like accounting, bookkeeping, payroll, tax preparation, and compliance reporting

- Reduced operational risk during the initial setup since the partner handles recruitment, HR, IT, and compliance

- Scalable workforce planning, enabling structured growth rather than ad hoc hiring

- Stronger data security and IP ownership, as all compliance and governance eventually align with the client’s framework

- Sustainable knowledge retention, since expertise stays within the client’s owned offshore center long-term

Which Model is Right for You?

Both BOT and staff augmentation are proven models helping U.S. businesses overcome the talent crisis and cost pressures in accounting. The decision ultimately depends on whether you want speed and flexibility or long-term ownership and strategic control.

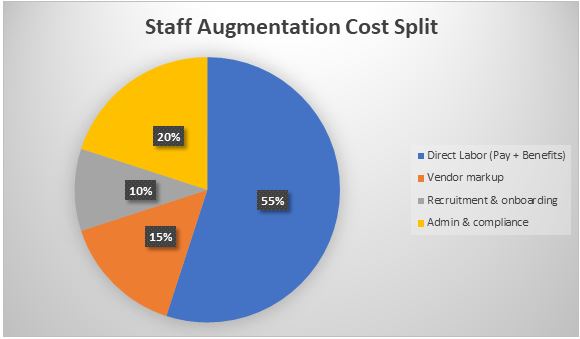

Choose Staff Augmentation if you need quick, flexible, short-term support to meet seasonal demands or project surges. But it often comes with hidden costs, communication barriers, and a lack of ownership.

The Build-Operate-Transfer (BOT) model, on the other hand, changes the equation by offering a balanced approach where you get an offshore unit that’s truly yours. Since the resources, infrastructure, and teams are directly managed by you, you get better control and savings than traditional outsourcing.

The Build-Operate-Transfer (BOT) model, thus, gives U.S. firms a clear edge over traditional outsourcing.

Which model should you choose? The one that aligns with your business vision, growth stage, and long-term goals.

Want to explore the right model for your firm? Schedule a discovery call to know how we can help you build a cost-effective, future-ready global accounting team – at the most cost-effective price point.