Automated Accounts Receivable Services That Strengthen the Bottom Line

Smarter Receivables Management for a Healthier Bottom Line

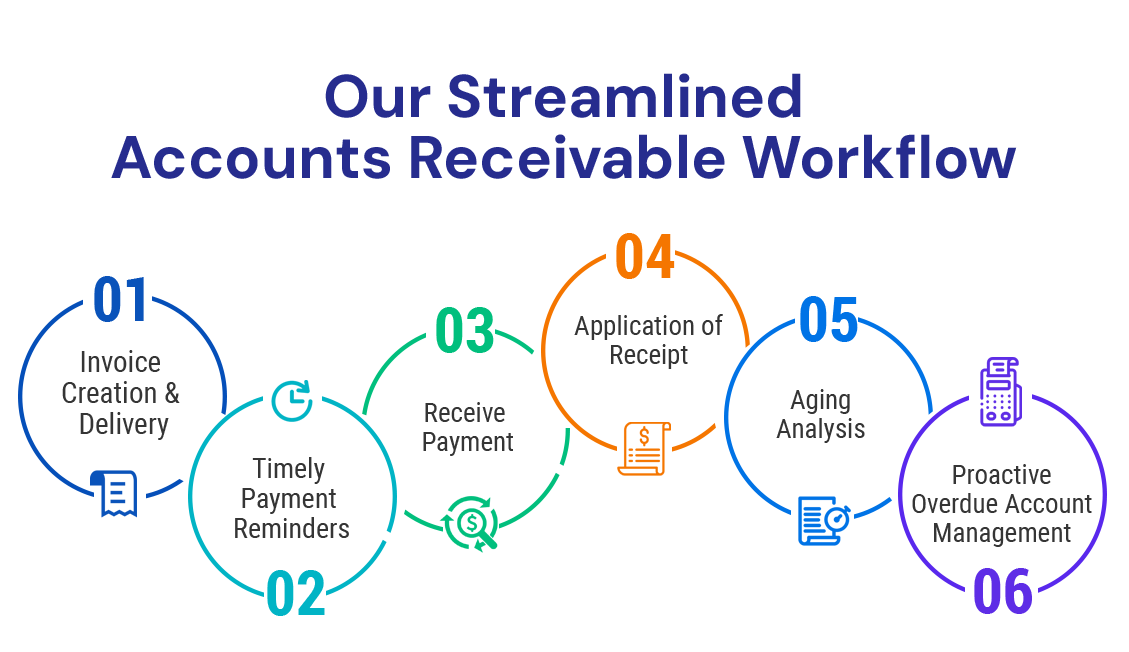

We transform your AR process from reactive to proactive. Our clear workflows and smarter automation help your business gain both liquidity and profitability.

Faster Collections, Stronger Cash Flow

By automating your AR process, we help you get paid quickly, reducing payment delays and improving liquidity.

Complete Cash Flow

Visibility

Our clear, transparent dashboards provide real-time insight into every invoice, outstanding payment, and collection trend.

Seamless Software

Integration

Our AR process integrates effortlessly with your existing software — no disruption, just smooth automation.

Scalable,

Expert-Led Support

Our services scale with your business while keeping accuracy and compliance intact.

Complete Accounts Receivable Solutions for Modern Businesses

From invoice to cash, we streamline every step of the receivables process so your business never faces collection gaps or cash flow surprises.

We prepare accurate invoices based on your contracts or sales data and deliver them to your customers promptly. Our automated processes make the entire process seamless and error-free.

Our team monitors each invoice until payment is received. Automated reminders and professional follow-ups help speed up collections while maintaining customer goodwill.

We manage credit memos carefully to ensure customer accounts are accurate and up-to-date, avoiding confusion and delays in payments.

We perform regular AR ledger reconciliations to catch and fix errors early, keeping your financial data clean, accurate, and audit-ready.

Our team monitors overdue accounts, helps recover payments where possible, and manages bad debts efficiently to minimize your financial risk.

We handle discrepancies and communication with clients, ensuring quick resolutions and minimal disruption to your cash flow.

Every payment is tracked and matched accurately to its invoice. This ensures your books are always up to date and your reporting error-free.

We provide regular AR aging reports, collection summaries, and predictive cash flow insights — giving you a complete picture of your receivables health.

We check customer credit histories and set smart payment terms to protect you from bad debt.

We help you in pursuing and collecting outstanding payments. We send reminders and do consistent follow-ups to reduce outstanding balances and minimize bad debt risks.

We generate reports, analyze trends, and provide strategic insights to give you a complete picture of your finances. This helps you stay up to date on the financial health of your business.

We handle inquiries, resolve disputes, and provide support related to accounts receivable management services. Our team helps you enhance payment compliance, reduce delays, and improve overall satisfaction.

Flexible Engagement Models To

Meet Your Business Needs

The KnowVisory Advantage

We accelerate your collections and free up working capital to invest in growth.

Our experts eliminate invoice mistakes that lead to payment delays. Every invoice is carefully verified before it’s sent for billing.

Our clear, transparent dashboards provide real-time insight into every invoice, outstanding payment, and collection trend.

Our comprehensive dashboards provide complete visibility into outstanding payments, overdue accounts, and revenue forecasts.

Our services scale with your business — no matter how many clients or invoices you manage.

We ensure every receivable aligns with accounting standards and tax regulations. We keep your records clean and audit-ready.

Gain Clarity, Control, and Consistency in Your Receivables

FAQs

How does outsourcing AR save me money?

When you outsource AR services, you avoid the costs associated with hiring & training employees. You also save on money that goes into buying the latest bookkeeping software. Plus, you gain instant, hassle-free access to a team of certified and experienced bookkeepers who diligently work with you to reduce late payments and cut bad debt losses. By outsourcing their AR & AP services, most clients have saved 30% to 40% in costs versus when they were managing these bookkeeping processes in-house.

Can you integrate with our existing accounting software?

Yes. We integrate seamlessly with QuickBooks, Xero, NetSuite, and other systems you already use — so there’s no disruption.

What types of businesses benefit from AR outsourcing?

Businesses of all sizes – from startups to enterprises – across industries like healthcare, retail, logistics, manufacturing, and professional services benefit from AR outsourcing.

Will I still have control over collections?

Absolutely. You retain full control over payment terms, credit limits, and escalation protocols. We simply manage the process efficiently on your behalf.

How do you handle delayed or missed payments?

We follow a structured escalation process — from gentle reminders to final notices — while maintaining professionalism and positive client relations.

What if a customer disputes an invoice?

We investigate, mediate, and resolve disputes on your behalf. We send them timely reminders and work with you to create friendly payment terms so that payments can be made quickly and accurately.

How often will I get updates?

With weekly cash flow reports and 24/7 access to your dashboard, we offer real-time access to your books and balances. Need a quick check-in or have a question? Our bookkeeping experts are just a call or email away.

How do I get started with your AR services?

Simply contact us for a free consultation. We’ll assess your current process, understand your pain points, and create a tailored AR management solution for your business.