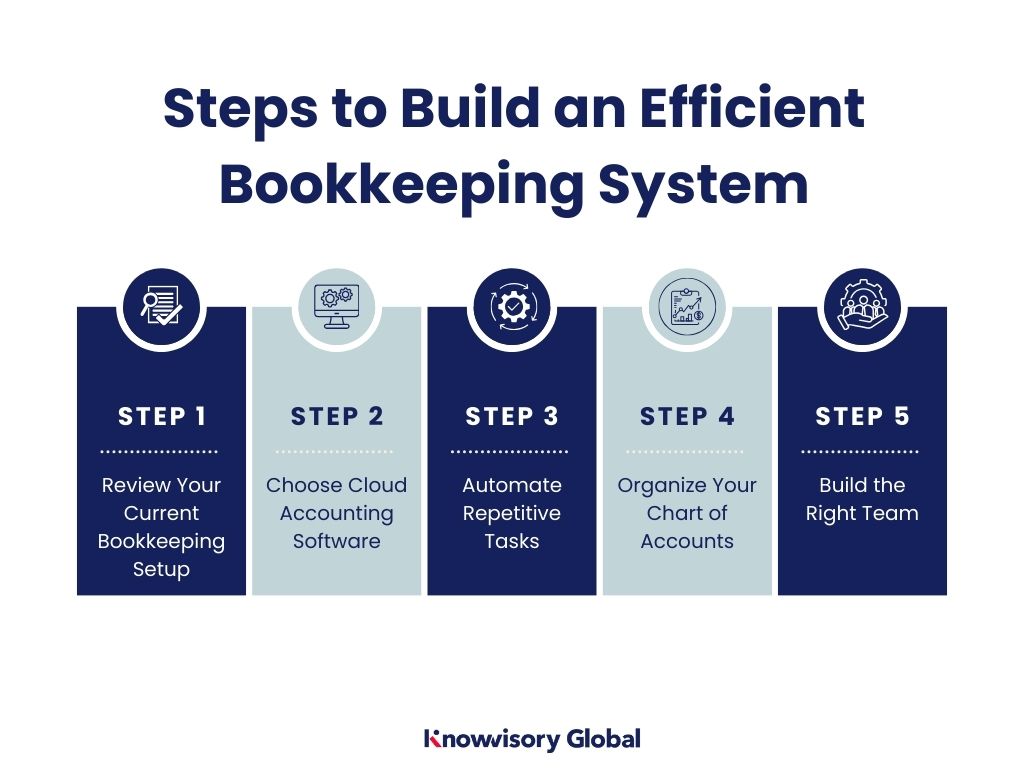

Here’s how you can build one that works now and in the future.

Step 1: Review Your Current Bookkeeping Setup

Start by looking at how you currently manage your finances.

- List your tools: Are you using a manual spreadsheet-based method or leveraging software to manage your bookkeeping tasks? Whatever you are using to track money, write it down.

- Identify process bottlenecks: Identify tasks that are taking too much time or are leading to errors. Are you struggling with manual data entry methods or lengthy bank reconciliation processes? Is disorganized reporting or outdated methods for tracking expenses slowing you down? Note everything down to know what’s derailing your progress.

- Think ahead: Check if your business grows, will your system still work? Will you have more transactions to handle or new locations to manage? Writing down all potential upcoming challenges can help you know what to fix.

|Also Read: Outsourced Bookkeeping versus Automation: Which Works Better?|

Step 2: Choose Cloud Accounting Software

Switching to cloud-based accounting software can make your bookkeeping more efficient. Cloud software allows you to access your financial data from anywhere. It keeps your information secure and often offers features like real-time reporting and automation. But when scaling, look for software that supports your future needs.

Key features to look for:

- Multi-currency support

- Custom workflows

- Automated bank feeds

- Anytime, anywhere accessibility

- Custom dashboards and real-time reports

- Automation tools

- Audit trails and role-based access

- Easy app integration

Need help? Experts at KnowVisory Global can help you set up an efficient cloud system. We can move your old data to the cloud and teach your team how to use it. We also provide ongoing support and help your system grow with your business.

Step 3: Automate Repetitive Tasks

Automation means using software to do things for you. It can save you time and reduce errors. Set up your software to automatically handle tasks like bank reconciliations, invoice processing, and expense tracking. By automating these processes, you can focus more on growing your business and less on manual bookkeeping tasks.

Some tasks that you must automate include:

- Bank reconciliations

- Expense management

- Invoice processing

- Revenue recognition

- Financial reporting

To make your accounting automation run smoothly, it’s important to connect these key tools:

- Payment Systems: Link your payment apps, sales systems, or online stores to your accounting software. This helps record all sales and payments automatically.

- Bank Integration: Set up daily bank feeds so your transactions show up without manual entry. You can even create rules to sort repeat charges by vendor or amount.

- Expense Management Tools: Use apps to scan receipts, track employee purchases, and send approved expenses right into your accounting software.

Step 4: Organize Your Chart of Accounts

A well-structured chart of accounts makes it easier to track your finances. Organize your accounts into categories like assets, liabilities, equity, revenue, and expenses. Use clear and consistent naming conventions and leave room for future accounts as your business expands. This structure will help you generate accurate financial reports and make informed decisions.

Step 5: Build the Right Team

Having the right people to manage your bookkeeping is crucial to keep your functions working efficiently. You can choose from a full-time in-house team to outsourcing your bookkeeping system to professional service providers, or co-sourcing (i.e., using a combination of both).

Here’s a quick comparison and the advantages and limitations of each option:

| Option | What It Means | Benefits | Limitations |

| In-House Team | You hire and manage your own staff | Full control, the team knows your business well | It is costly, slower to scale, or adjust |

| Outsourcing | You hire an outside company to handle your bookkeeping | Saves time and money, you get expert help instantly | May need constant communication |

| Co-Sourcing | You use both in-house staff and an outside team | Flexible, balance of control and expertise | It can be tricky to manage roles and teamwork |

Pick the option that fits your budget and how much control you want to keep. If you choose to build an in-house team, make sure to provide regular training to keep your team updated on best bookkeeping practices and the tools you use. With outsourced bookkeeping services, you may alleviate the training need as the outsourcing company takes care of training and keeping their teams updated on the latest bookkeeping tools and practices.

Next Steps for Implementation

Creating a bookkeeping system that can grow with your business takes a few smart steps. Start by looking at your current setup – what’s working and what’s not. Then, choose cloud accounting software that fits your needs and allows you to work from anywhere.

Next, bring in automation to handle routine tasks like bank feeds and invoices. Organize your chart of accounts so your records are easy to read and understand. Finally, build a team that can manage your system well – whether you want to do it in-house or transition to an outsourced bookkeeping model, or enjoy a mix of both.

Once your system is in place:

- Train your team on how to use the tools properly

- Set clear roles and responsibilities so tasks don’t get missed

- Review your setup regularly to make sure it still works as you grow

- Stay updated with new features in your accounting software

- Keep data safe by setting permissions and backing up your files

By following these steps, you’ll create a strong, flexible bookkeeping system that helps your business stay organized, save time, and grow with confidence.