Taxes are always confusing – especially for business owners and people outside a regular W-2, like freelancers and gig workers. For them, the IRS doesn’t wait until April to collect taxes. They expect self-employed people to pay taxes throughout the year – to avoid penalties and a big bill later.

So, if your income isn’t automatically taxed through payroll, you’re expected to pay estimated taxes every quarter.

Estimated taxes are quarterly payments that may be required when your income isn’t fully covered by withholdings.

Who Must Pay Estimated Taxes?

You likely need to make estimated payments if you:

- Expect to owe more than $1,000 in federal taxes for 2026 (individuals)

- Run a corporation and expect to owe more than $5,00 in federal taxes (corporations)

- Earn income that’s not covered by withholding, such as:

- Freelancing or contracting

- Sole proprietorship revenue

- Partnership and LLC profits

- S-corporation shareholder income

- Rental income, investments, or other untaxed earnings

In short, if the IRS isn’t already deducting taxes out as you earn, then you are expected to pay your tax dues on your own — four times a year.

When to Pay Estimated Taxes in 2026

For self-employed individuals, the IRS follows a “pay-as-you-go” system. These are the quarterly deadlines for the 2026 tax year:

| Income Period | Estimated Tax Due |

| Jan 1 – Mar 31 | April 15, 2026 |

| Apr 1 – May 31 | June 15, 2026 |

| Jun 1 – Aug 31 | September 15, 2026 |

| Sep 1 – Dec 31 | January 15, 2027 |

If a due date falls on a weekend or holiday, it automatically moves to the next business day.

Please note:

You may also need to pay estimated tax for your state, which has varying deadlines from one state to another.

How to Calculate Your Quarterly Estimated Taxes

You can calculate your quarterly taxes by following either of the two methods:

1. Using Your Current-Year Estimates (Annualized Method)

This method involves forecasting your income, deductions, credits, and tax for 2026 and paying at least 90% of what you expect to owe.

Ideal for:

- Seasonal businesses

- Income that fluctuates month to month

- Business owners whose earnings jump during certain quarters

If your income increases mid-year, adjust your future payments accordingly to avoid falling short.

2. Using Last Year’s Tax Bill (Safe Harbor Rule)

A simpler method that’s based on the quarterly payments you made during the previous year.

- Pay 100% of last year’s tax liability (divided by four)

- Or 110% if your adjusted gross income exceeded $150,000

This approach works well if your income is steady or increasing.

How to Make Estimated Tax Payments

The IRS offers multiple payment methods:

- IRS Direct Pay — pay directly from your bank account

- Electronic Federal Tax Payment System (EFTPS)

- Debit/credit card (fees apply)

- Mailing a check with Form 1040-ES vouchers

You can pay weekly, monthly, or as often as you like — as long as the correct amount is paid by each quarterly deadline.

If your withholding equals at least 90% of your current-year tax or 100% of last year’s tax, you may avoid quarterly payments.

Penalties for Not Paying Enough Estimated Taxes

If you don’t pay enough tax throughout the year, the IRS may charge an underpayment penalty. The penalty is based on:

- The underpaid amount

- The number of days it remained unpaid

- The current IRS interest rate published at https://www.irs.gov/payments/quarterly-interest-rates.

For many taxpayers, this rate hovers around 8%, but it can change quarterly. Remember, penalties are in addition to interest owed on unpaid tax.

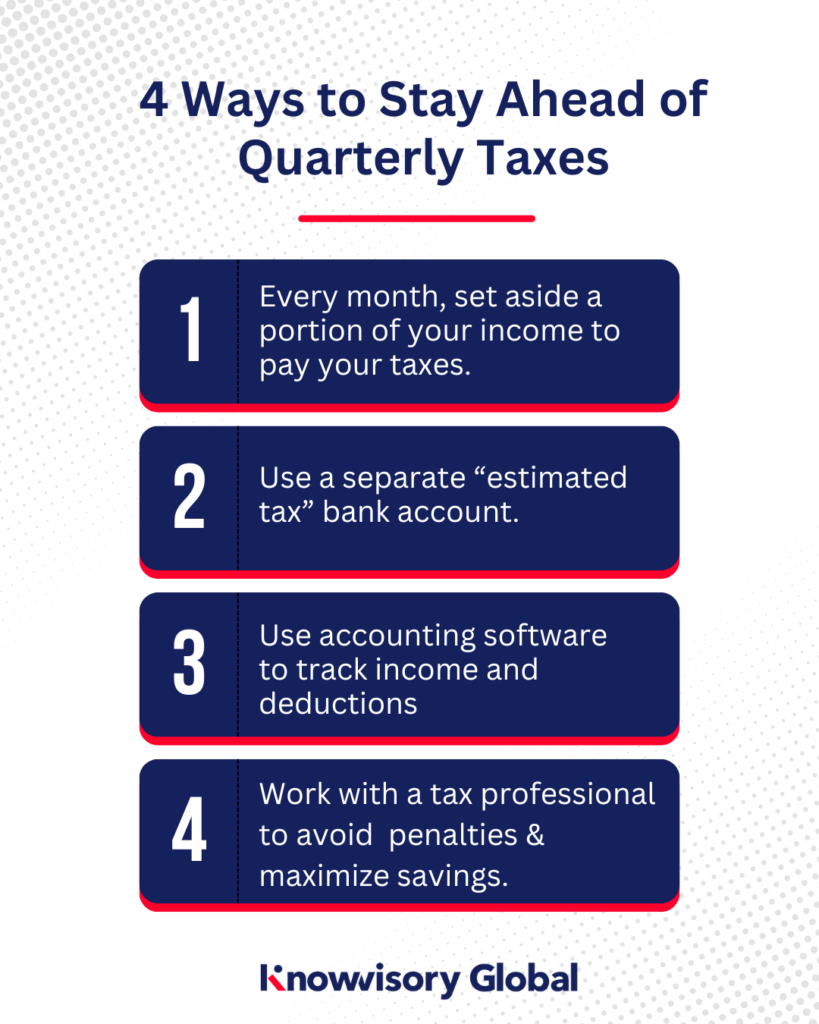

Tips for Business Owners Paying Quarterly Taxes

For small business owners, the biggest challenge is often cash flow. Here are practical ways to stay ahead:

- Just like a paycheck deducts taxes automatically, set aside a percentage of each payment before spending anything.

- Use a separate bank account to avoid using tax money for business expenses.

- Use accounting software to track income and deductions.

- Work with an experienced tax professional. They can track changes in your income, choose the best calculation method, identify applicable deductions and credits, and minimize the risk of missed deadlines or penalties.

Need Help? Partner with KnowVisory Global and Stay Prepared for Tax Time

Tax laws evolve each year; staying compliant needs planning and the right approach.

At KnowVisory Global, we help business owners and self-employed individuals stay tax-ready year-round. Our seasoned accountants, bookkeepers and tax advisors keep your records accurate, your numbers up to date, and your business ready for every tax deadline.

With professional tools and expert support, we make quarterly tax compliance easier. Partner with us and navigate your tax obligations smoothly and accurately, every quarter.